Greetings to our smart people of Rivers State and welcome to another episode of RivEthics on Radio, our character-building weekend show. Please remember that in the school of life, the principle of the more you learn the more you earn works well as in the campus. This episode is titled “Financial Discipline”.

Financial discipline can be said to be the bridge between financial goals and accomplishment. Among other things, financial discipline teaches us to never depend on a single income but rather to create multiple streams of income as quickly as we can. That singular step ensures an organic and dynamic growth of one’s net worth.

We also learn through financial discipline to take calculated risks in business. The rule is to never test the depth of a river with both feet. The same rule enjoins us when it comes to investing, to never put all eggs in one basket.

We all know that saving is a major part of financial discipline, but maybe some have been trying to do it the wrong way. The wrong way is to try to save what is left after spending. The right way is to spend what is left after saving.

Financial Discipline teaches the difference between needs and wants. Things needed are essentials whereas wants are merely desirable. If you buy things you don’t need, soon you will be selling things you need for sustenance.

Financial discipline teaches us to be aggressive in growing our net worth. You have to do whatever you can to improve your net worth, either by reducing your debt, increasing your savings, or increasing your income. Preferably all of the above measures should be applied. Look for new ways to make money, or to get paid more for what you do. Over the course of months, if you calculate your net worth each month, you’ll see it grow. From there you are motivated to do more and scale up.

The most important step to take in achieving financial prudence is to study personal finance. We should both study and apply the knowledge gained. The experts say that personal finance is 80% behaviour and 20% head knowledge. The more you educate yourself, the better your finances will be. Knowledge of personal finance gives you control and keeps you on the driving seat on money matters. There are literally hundreds of thousands of books, articles, audio and video content on personal finance to learn from. Money respects and follows those who discover its secrets and runs from those who are financially ignorant.

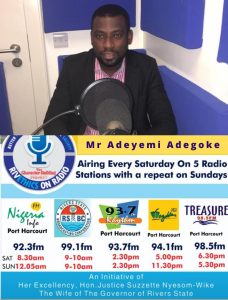

Let us listen to our guest speaker as he takes us through the topic. He is Mr. Adeyemi Adegoke, a financial and human capital expert based in Port Harcourt.

Our hardworking Rivers People, please remember to always let your manners speak for you.

God bless and keep you and your families and God bless Rivers State.